The latest Scamwatch statistics from the Australian Competition and Consumer Commission (ACCC) show that Australians lost a staggering $95 million to all types of scams in March 2022—the greatest monthly amount on Scamwatch’s record. Australians have already lost $167 million to scams so far this year compared with $323 million lost throughout the whole of 2021, according to Scamwatch data.

Rising more than 150% from February, the amount that Australians lost during March also represents a significant increase of nearly 400% from the $20 million reported during the same month last year.

Notably, despite an increase in the amount lost to scams, the number of reports decreased by 10% in March 2022, with 16,446 scams recorded. This suggests scammers have been finding success with their tactics in fewer attempts.

Investment and phishing scams dominate

In March, investment scams were the single greatest source of money loss for Australians, totalling $82 million. That’s more than three times higher than the previous monthly record of $27 million set in February. Also, the Scamwatch data shows that men in Australia were significantly more impacted by investment scams during March, accounting for 92% of losses.

Phishing scams were the most recorded scam type—and that Scamwatch finding aligns with research conducted for the “2022 State of the Phish” report from Proofpoint. The report notes that email-based attacks dominated the threat landscape in Australia in 2021, with more than 90% of survey respondents from Australia acknowledging that their organisation faced spear phishing, business email compromise (BEC) and email-based ransomware attacks last year.

More key findings from ACCC’s Scamwatch

Following are additional March 2022 statistics from the Scamwatch site:

- Australians aged 25 to 34 saw the highest total losses due to scams—$65 million. Queensland residents suffered the greatest losses at $67 million, followed by New South Wales residents at $11 million.

- Australians lost the most money to mobile app scams in March—$65 million

- Phone scams accounted for the greatest number of reports (6,135 or 37%).

- Phishing scams were the most-recorded scam type (4,773 reports).

- Men were disproportionately affected by scams, accounting for 87% of all the money that Australians lost to scams during March.

“The latest figures demonstrate just how damaging scams can be and the impact they are continuing to have on Australians,” says Crispin Kerr, vice president, ANZ, at Proofpoint. “As the data shows, investment scams continue to be the most profitable and one of the most attractive scams due to the promise of quick cash and money wins. Younger Australians are most susceptible to these scams, which range from cryptocurrency scams to celebrity endorsements to unsolicited phone calls promising an investment opportunity like shares or stocks.”

The rising popularity of cryptocurrency is likely contributing to the increase in investment scam losses and activity, Kerr says. “Cryptocurrency is another avenue for criminals to exploit Australians and take advantage of a less-regulated environment, where digital currencies are more difficult to track,” he explains. “Cybercriminals have become more sophisticated and are even setting up fake cryptocurrency exchange platforms to carry out cryptojacking—tricking people into using their computers and mobile devices to mine cryptocurrency against their will.”

Kerr adds, ““We urge Australians to be extra vigilant, especially when interacting with people they don’t know online and over the phone. Scammers will go to great lengths to form relationships to appear legitimate, convincing Australians to hand over their personal and financial information. So, always seek financial advice if you are looking to invest and only do so through reputable channels.”

Avoiding scams—top tips from Proofpoint

Kerr also emphasises that knowing how to spot a scam is an important first defence and one of the best things people can do to protect themselves. “Remember, if something looks or sounds too good to be true, it almost always is,” he says.

With that advice in mind, here are some additional tips from Proofpoint for avoiding scams:

- Never share personal or financial information, including bank account or credit card details, with someone you don’t know.

- Don’t click through links or open attachments from unknown senders, whether via email, text, social media or online.

- Look out for spelling and grammatical errors, as they can suggest a message is a scam.

- Only communicate with an organisation through official channels found on company websites.

- Don’t share passwords with people—and be sure to change your passwords regularly. Consider using a password manager to help protect your personal information from being stolen.

- Be cautious about phone calls or emails that come out of the blue touting investment offers or travel and other prizes.

Help your people become effective defenders

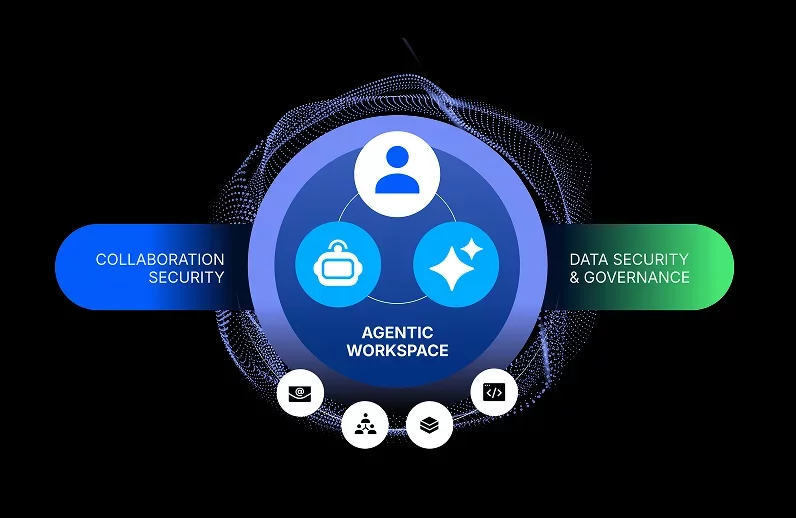

People are the last line of defence for an organisation—but they are also the biggest and most dynamic attack surface. The rapidly evolving threat landscape coupled with the massive growth of BEC requires a new security paradigm. Empowering your people to become a critical pillar of your cybersecurity defences is essential. The key is to build a customised security culture for your organisation: To learn how, download the Proofpoint e-book, “Building a Sustainable Security Culture.”